Banking on Satisfaction: How Canadians Really Feel About Their Banks

By: Lucy Zemljic on August 15, 2014

A dash of customer service, a spoonful of financial products, a pinch of problem resolution – is this the perfect recipe for banking satisfaction? J.D. Power and Associates tried to figure out just that with its latest Canadian Retail Banking Customer Satisfaction Study. As it turns out, TD Canada Trust and Tangerine have the recipe down-pat, both ranking 1st in their segments.

Last year, the study revealed that customer satisfaction has improved, but Canadians still perceive banking institutions as profit-driven and lacking innovation. This year’s study delved deeper into the factors driving customer satisfaction – read on to find out how Canadians really feel about their banks.

The Method

The 2014 Canadian Retail Banking Customer Satisfaction Study was conducted from May to June of this year, and is based on responses from over 17,000 customers. J.D. Power measured customer satisfaction with retail banks in three segments: the Big 5 Banks, Midsize Banks and Credit Unions. There were seven factors examined, each measured for customer satisfaction:

- Product Offerings

- Personal Service

- Self-Service

- Facilities

- Communications

- Financial Advisor/Account Manager

- Problem Resolution

The Findings

Banks Need to Communicate.

Communication is key, and when it comes to banking the same holds true. According to the study, when banks communicate effectively, customers report far fewer problems – the banking customers that “completely understand” their fees reported issues cropping up 11% of the time, as opposed to the 18% problem frequency rate from customers that reported not understanding their fees at all.

Jim Miller, senior director of the banking practice at J.D. Power, says these findings underscore “the importance of fully explaining the full range of banking products available to consumers at their primary bank.”

Customer satisfaction leads to banking loyalty, says Miller – “highly satisfied” customers are less likely to switch banks, are more likely to hold more products and balances with their banking institution, and are more than twice as likely to report that they plan on “definitely reusing the bank for future financial needs” and recommendations, as compared to customers with only medium satisfaction levels.

Other Takeaways:

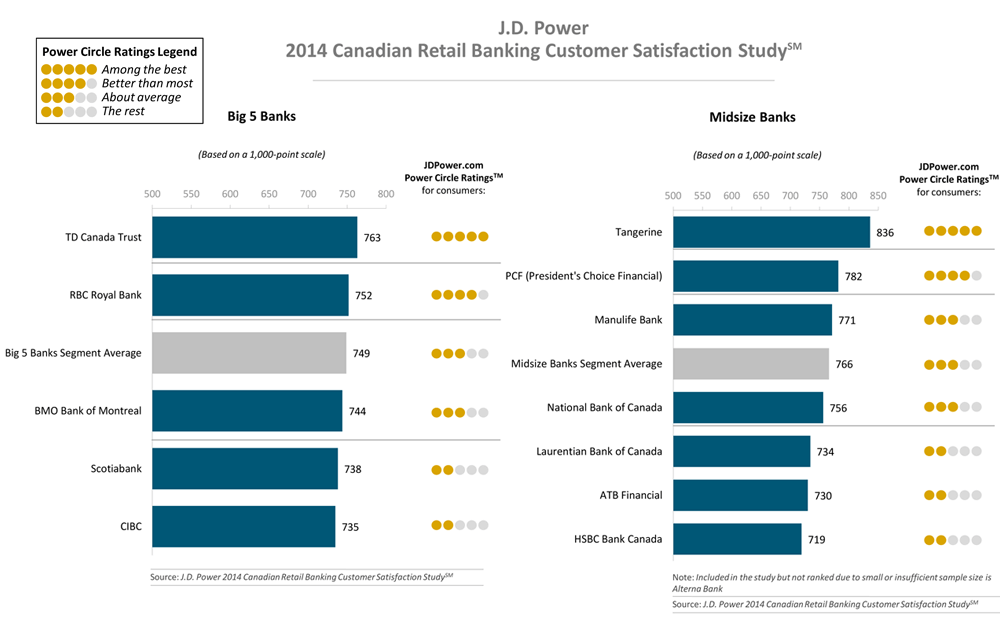

- Overall customer satisfaction for the Big 5 Banks average 749 points on a scale of 1,000

- For the Midsize Banks segment, the average was 766 out of 1,000

- 26% of overall satisfaction was determined by product satisfaction, including chequing accounts, savings accounts, credit cards and loans

- 19% of overall satisfaction was determined by the customers’ satisfaction with personal service, such as in-person reps and contact centre representatives (through both phone and online communication)

- 19% of satisfaction was also determined by self-service, like mobile banking, ABMs (automated banking machines), and online and automated phone systems – meaning that face-to-face and self-service banking methods are equally as important to customers

The Rankings

Among the Big 5, TD comes out on top.

Since the study’s inception nine years ago, TD Canada Trust has consistently ranked 1st in overall customer satisfaction among the Big 5 Banks – it reached a score of 763 on the 1,000-point scale. TD Bank performed well in all of the seven satisfaction factors, especially for the facilities factor.

Among the Midsize, Tangerine takes the cake.

When it comes to Midsize Banks, Tangerine (formerly known as ING Direct Canada) ranks 1st in customer satisfaction for the third year in a row, reaching a score of 836. Tangerine did particularly well within the product, communication, and personal- and self-service factors.

Take a look at the graphs below pulled from the study itself:

The Final Word

While studies like this are insightful, it’s important not to lose focus of what banking should be all about – you. Remember that as a customer, you have the ability to compare banks and financial products – you don’t need to stay loyal to your bank if it’s not satisfying your needs. So go ahead and comparison shop! It may very well save you money in the long run.

Comments