Toronto Penthouse Costs $33 Million, How Much Is The Mortgage?

By: Gary Parkinson on August 29, 2014

image by Darren Calabrese with the National Post

If you live in or have visited the financial district in Toronto since 2011, you likely noticed the Trump International Hotel & Tower near the corners of Bay and Adelaide Streets. The tower is named after US real estate and investment guru Donald Trump, who is also a minority shareholder in the skyscraper.

The tower is 65 floors tall, though only 57 floors are currently occupied by people. At the very top of the building is the penthouse suite, which is currently under construction. The property managers are waiting for a buyer to invest in the suite before completing construction inside the unit.

Once work is completed, the penthouse will be 11,755 square feet in size – stretching across more space than many family homes in Toronto. Managers are asking for $2,800 per square foot on the penthouse suite, which adds up to approximately $33 million for the entire condo. If an investor does pay that asking price, it will become the most expensive condo in all of Canada.

The odds are that the condo will be an investment made by a wealthy buyer from overseas, though the managers say they are looking for someone with ties to Canada, and ideally Toronto. But even the wealthiest investor should expect to fork over a lot of money just to maintain the unit – let alone live in it.

Mickael Damelincourt is the General Manager at Trump Hotel, who spoke with the Toronto Star about the condo. He says the maintenance fees for the penthouse suite will add up to over $8,000 per month. Property taxes for the condo are expected to cost $6,000 each month, with heating, hydro, and other utilities costing even more money.

The person that does invest in the suite is likely wealthy enough to pay the entire $33 million asking price upfront. But consider the possibility that the buyer would want a mortgage to help pay for the penthouse over time. If the buyer does decide on a mortgage, what are the options?

Let’s assume that a down payment of 20 percent is made, which is common on many household purchases. That would amount to $6.6 million upfront, and leave $26.4 million to be paid over the lifetime of the loan.

The most popular mortgage term in Canada is a 5 year term, and the loan itself can be amortized up to 25 years. With all the numbers ready to be calculated, let’s look at what the buyer can expect to pay through one of Canada’s largest banks compared to what they could find using online mortgage rate comparison sites like LowestRates.ca.

For this scenario, we'll compare the current posted rates from TD Bank to the lowest mortgage rate offers from LowestRates.ca. The calculations are made using 5 year variable and fixed mortgage rates offers – first from TD and then found through LowestRates.ca.

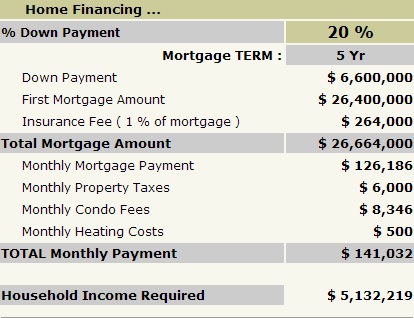

The amount that the buyer can expect to pay per month using a 5 year variable rate of 3.00 percent from TD Bank is $126,186, based on the following data:

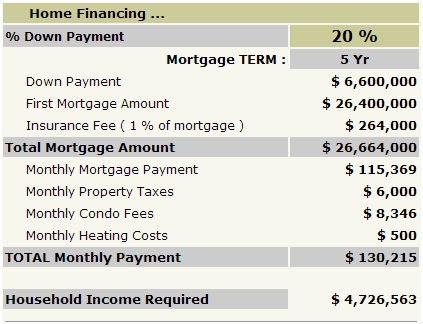

On the other hand, the amount that the buyer can expect to pay per month using a 5 year variable rate of 2.19 percent found using LowestRates.ca is $115,369 – nearly $11,000 less every month, based on the following data:

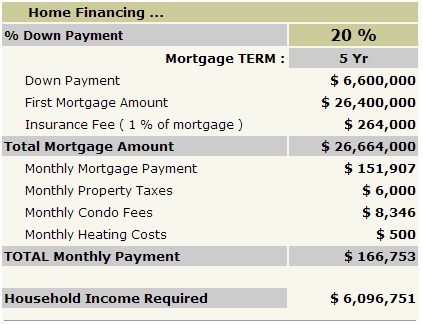

A 5 year fixed mortgage rate is also one of the most popular terms in Canada. Using a 5 year fixed rate of 4.79 percent from TD Bank, the buyer can expect to pay $151,907 per month, based on the following data:

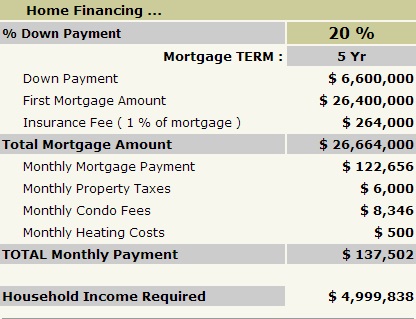

However by finding the best 5 year fixed mortgage rate offer of 2.74 percent through LowestRates.ca, the buyer can expect to pay $122,656 per month – totaling savings of nearly $30,000 every month, based on the following data:

Even the wealthiest buyers can benefit from taking a few minutes to find the best mortgage rate offers outside of Canada’s major banks. On a condo worth $33 million, those few minutes can literally – as seen in the examples, save tens of thousands of dollars every month, and much more over the lifetime of the loan.

.jpg?itok=SnQQgxS0)