REPORT: Here’s how to save on car insurance as you age

According to LowestRates.ca data, the insurance company that gave you the lowest rate in your 20s, 30s, and 40s might not be the right one for you later on in life.

This article has been updated from a previous version.

With age comes wisdom — and lower car insurance costs.

For a number of reasons, the cost of car insurance declines for the average driver as they get older. Your insurance history and driving record grow longer. Teenage drivers, once listed as your secondary drivers, get their own policy. You no longer commute every day. You downsize and sell one of your cars. The list goes on.

But, even when we control for these lifestyle changes, some insurance companies lead the market in offering cheaper rates to experienced drivers.

We crunched the data generated by the hundreds of thousands of car insurance quotes completed each year on the LowestRates.ca website and found that the insurance company that gave you the lowest rate in your 20s, 30s, and 40s might not be the right one for you later on in life.

Keep reading to learn how you can use this information to find — and keep — the lowest possible auto insurance rate.

Key findings:

Car insurance rates in Ontario, Alberta, and Quebec begin falling after age 30.

Not comparing rates from different insurance companies could result in you paying up to $14,700 more than you need to over time.

The earlier an insurance company classifies you as a mature driver, the more substantial savings you’ll find over the long term.

What car insurance companies charge over a lifetime

To graph the lifetime cost of car insurance premiums, we used real data from people who have completed quotes on our site. We removed outliers — people who have either very expensive car insurance rates (due to being rated as high-risk drivers) and people who have very low car insurance rates (due to not using their car for commuting purposes, for example).

So what can the data tell us?

For the sake of the report we decided to exclude very young drivers, because when you’re in your early twenties, the cost of insurance is extremely high. But after your 25th birthday, you are now a full-fledged adult driver in the eyes of insurance companies.

Beyond age 30, rates get progressively lower.

However, some companies seek to maintain a customer base of drivers aged 40 and up — and by that, we mean that they offer lower premiums to these customers.

Why? Every insurance company has a different tolerance to risk. Some are more willing to insure younger, newer drivers (those who are considered high-risk), others are more skewed towards long-time drivers — which is why finding the right fit for you is key.

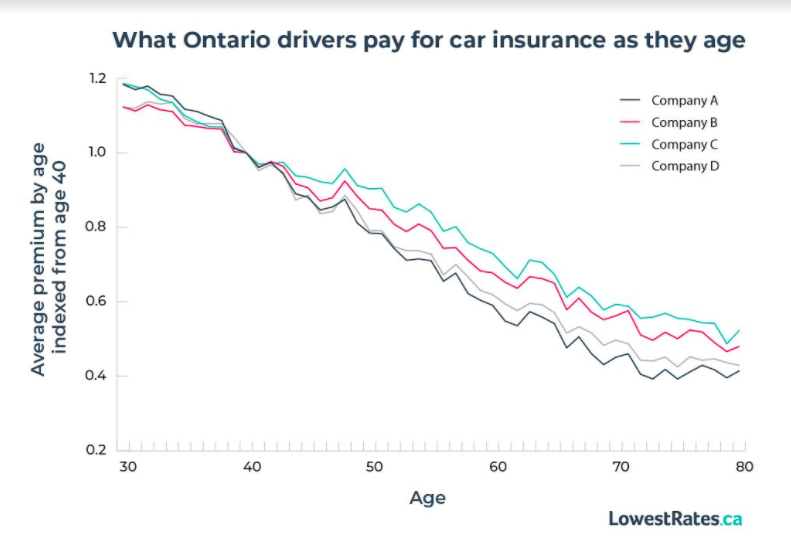

To illustrate, let’s look at the chart for Ontario. Company B offers the lowest rates for drivers in their 30s. At about the late-30s to early 40s, all four companies join up and offer roughly the same price. But by age 42, Company B starts charging customers more.

Company A, on the other hand, charges drivers in their 30s the most, but starts dropping their rates by age 40. By age 50, Company A is the cheapest option of all — and the rates stay low as the years go on.

If at age 49, an Ontario driver switched to company A instead of company B, they could save thousands of dollars by their 75th birthday — money that would be better off invested in a retirement savings or investment plan.

The savings would be even more drastic if they were previously insured by company C, which is at the highest end of the band.

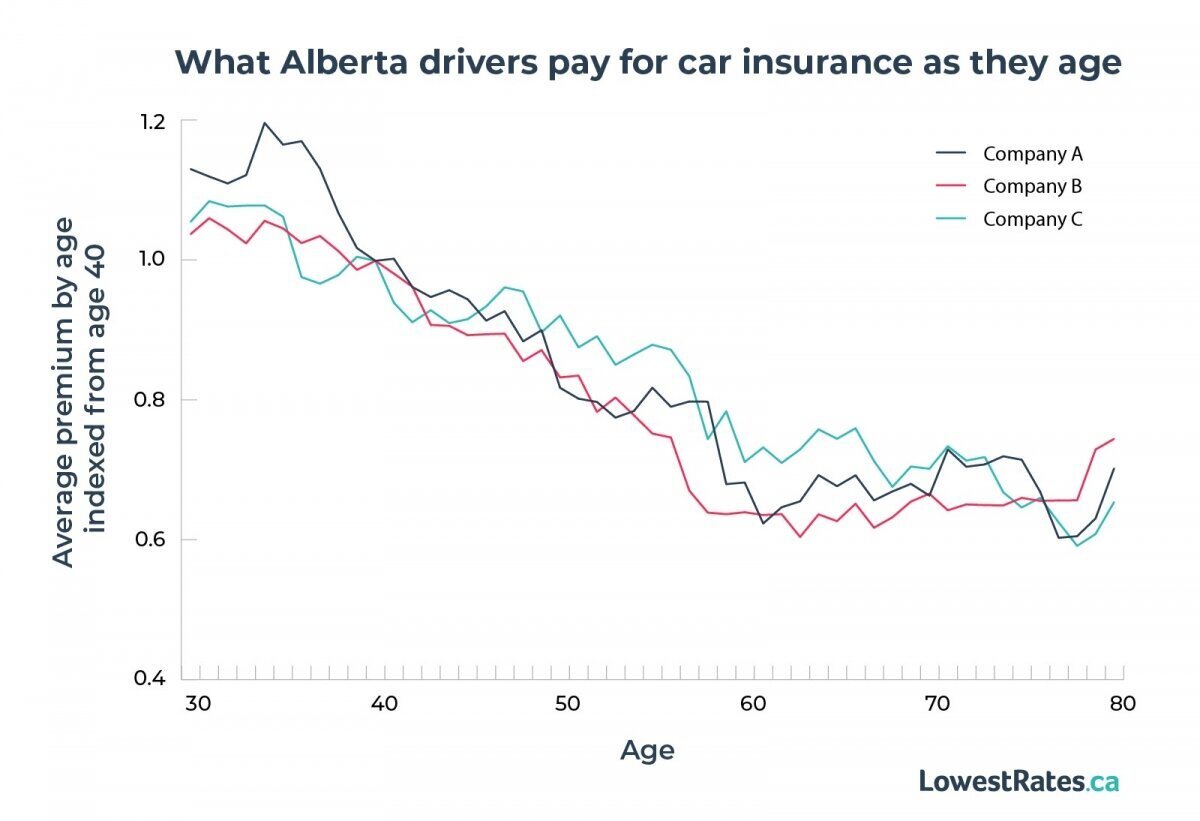

A similar trend occurs in Alberta. In that province, company A (a different insurance company than the one in the Ontario example) charges the highest premiums of all for drivers in their 30s to early-40s, but it becomes one of the lower-cost providers after age 50.

You can also see that rates in both provinces increase after age 70 and continue to rise through to age 80 and beyond. Drivers over 70 who are involved in car accidents tend to file large claims, as they require more care and time to recover. Unfortunately, this pushes the premiums up for everyone in their peer group in the insurance pool.

That’s why we say that age 70 is another milestone that should trigger drivers to compare car insurance policies.

Ontario

The average age that the downward curve intensifies for each company in Ontario

Car insurance rates begin falling after age 30 in Ontario. The second significant drop happens in your forties or early fifties. Here’s when that drop occurs for the Ontario car insurance companies we’ve included in the chart above:

- Company A: age 48

- Company B: age 48

- Company C: age 51

- Company D: age 42

Alberta

The average age that the downward curve intensifies for each company in Alberta

Car insurance rates start to decline after age 30 in Alberta. The next significant drop happens in your forties or early fifties. Here’s when that second drop occurs for the Alberta car insurance companies we’ve included in our chart:

- Company A: age 49

- Company B: age 49

- Company C: age 48

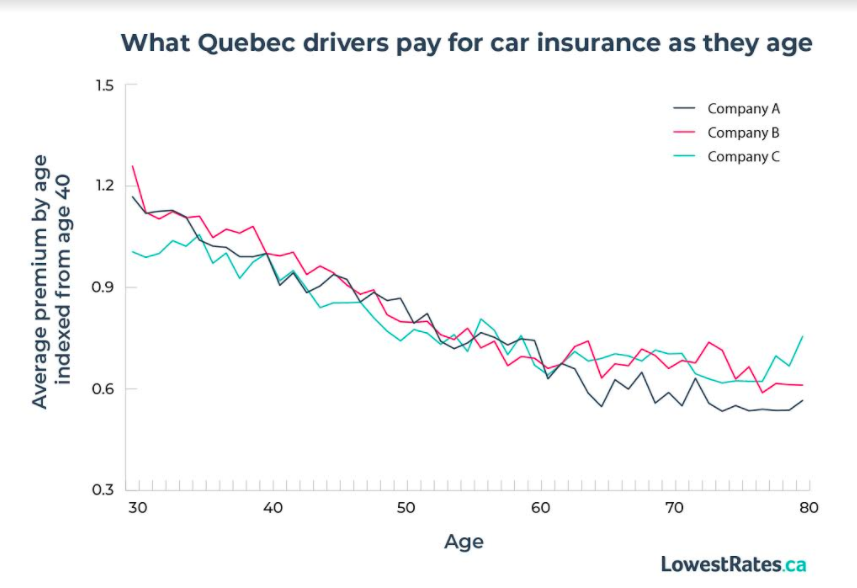

Quebec

The average age that the downward curve intensifies for each company in Quebec

Car insurance rates start to decline after age 30 in Quebec. The next significant drop happens in your forties or early fifties. Here’s when that second drop occurs for the Quebec car insurance companies we’ve included in our chart:

- Company A: age 45

- Company B: age 48

- Company C: age 40

Save money by switching car insurance companies at the right age

To ensure you’re always getting the lowest car insurance rate, we recommend comparing rates every time your policy is up for renewal.

We especially recommend starting to compare your car insurance in your early 40s and onward. As you can see from the charts above, rates start falling precipitously for customers in their 40s and upwards.

Aging works in your favour — at least with car insurance. As you get older, your insurance company will view you more positively, not worse (provided you pay your bill on time and keep your driving record clean).

One age we’ve singled out where you really want to make sure you start comparing is age 49.

Why age 49? Age 50 is the year that many car insurers begin rating you as a mature driver.

And according to our data, that’s the age that the rates offered by various car insurance companies start diverging, causing the widest variation in rates — meaning that some drivers are at risk of sticking with an insurer that charges too much.

But as mentioned, you can find significant savings by switching car insurance companies in your early 40s. To show you savings estimates in real terms, we used the data from the insurance companies featured in the charts above.

We were able to provide a savings range for each province. The numbers on the right side represent the total savings over 26 years while the left side shows the annual savings. In both cases, we’ve provided the range of savings you could realize by switching insurance companies.

Ontario

Annual savings range: $74 - $586

Total savings range (over 26 years): $1,850 - $14,650

Alberta

Annual savings range: $52 - $588

Total savings range (over 26 years): $1,300 - $14,700

Quebec

Annual savings range: $150 - $354

Total savings range (over 26 years): $3,750 - $8,850

How premiums decline after the big 4-0

Comparison shopping will usually get you a better deal on car insurance. But even if you do nothing, you’ll still likely see the cost of your car insurance go down each decade.

We’ve crunched quotes received on our website to calculate the average dollar amount by which car insurance rates decrease each decade; meaning, by the end of the decade, this is how much the average car insurance premium will have decreased.

The changes in car insurance prices with the progression of age were calculated by comparing the insurance cost of one age group with the insurance cost of the group before it. For example, the change in premiums for those aged 40-49 was determined by comparing the insurance costs of users aged 30-39.

Our methodology does not factor in rate increases due to inflation and rising claims costs. That will erode some of the dollar savings we are showing in a real-world context.

These results are from people completing quotes on the LowestRates.ca site. Individual circumstances and results will vary.

Ontario

Range of price decreases by the end of the decade

Female drivers

At ages 40-49: $450-700 reduction

At ages 50-59: $450-850 reduction

At ages 60-69: $550-$600 reduction

At ages 70-79: $350-$400 reduction

Male drivers

At ages 40-49: $650-$800 reduction

At ages 50-59: $400-$700 reduction

At ages 60-69: $600-$650 reduction

At ages 70-79: $400-$450 reduction

Alberta

Range of price decreases by the end of the decade

Female drivers

At ages 40-49: $100-$600 reduction

At ages 50-59: $100-$550 reduction

At ages 60-69: $0-$350 reduction

At ages 70-79: $150-$200 increase

Male drivers

At ages 40-49: $150-$650 reduction

At ages 50-59: $100-$550 reduction

At ages 60-69: $250 reduction -$150 increase

At ages 70-79: $100 reduction - $100 increase

Quebec

Range of price decreases by the end of the decade

Female drivers

At ages 40-49: $200-$250 reduction

At ages 50-59: $150-$200 reduction

At ages 60-69: $50-$150 reduction

At ages 70-79: $150-$200 reduction

Male drivers

At ages 40-49: $200-$250 reduction

At ages 50-59: $150-$200 reduction

At ages 60-69: $150-$200 reduction

At ages 70-79: $0-$100 reduction

Ways to get the cheapest possible car insurance rate as a senior

In your forties, it’s important to choose an insurance company that offers a steady reduction in insurance costs as you grow older. It’ll really pay off in your senior years.

Consumer watchdog and LowestRates.ca columnist Ellen Roseman recommends using the data provided in this report as a benchmark to track whether your car insurance premiums follow the average trend.

“In general, there is a tendency for people to stay with the same company,” says Roseman. “If you shop around too much it can hurt you — you may have first-time accident forgiveness that expires when you switch to a new company — but it helps to shop around every few years.”

Your premiums should follow the same trajectory as our charts. If they don’t, and you don’t have accidents or speeding tickets, it might be time to switch insurance companies. To prevent yourself from overpaying, Roseman advises consumers to keep close track of their car insurance payments.

“This report is a good argument to keep track of your bills, not just pay them. When you pay monthly you don’t pay much attention,” says Roseman, likening it to how some consumers only pay attention to the minimum payments on credit cards.

Set out to keep a record of your premiums over the years, advises Roseman. Checking in every year at renewal time will let you see if your premiums have fallen in the average range at the close of the decade. Your insurance premium might rise slightly one year to the next — sometimes moving to a new postal code can trigger a rate change — but it should average out to an overall decrease by the end of the decade.

In the best-case scenario, your premium should match the average decrease or exceed it.

How to ensure your premiums shrink on schedule

- When you’re buying car insurance, be sure to discuss age segmentation with your agent or broker. In the past, insurance companies were fairly uniform in how they segmented drivers, grouping them in five or 10-year segments. Advances in technology mean that insurers today are able to analyze statistical and demographic data with more precision and can adjust policies more frequently.

- But not every insurer has harnessed big data yet. Ask your agent or broker how your insurance company segments policyholders: are people categorized by birth year or are they lumped into age groups of five or ten years? An insurance company that groups drivers into small segments can offer a more individualized rate — if you’re a good driver, this usually translates into a cheaper policy.

- When you hit your forties, ask your insurance company when it starts to rate policyholders as “mature drivers.” The earlier a company rates you as a mature driver, the more savings you’ll find over the long term.

- Milestone events are a good time to shop around. Such events include:

- When you hit a milestone birthday or every ten years

- When your children get their own car insurance policies and they are no longer secondary drivers on yours

- If you move out of the city ( rural areas tend to have lower insurance premiums)

- If you reduce the number of cars you own

- When you retire (many car insurers offer discounts for being a retiree)

- Consider signing up for telematics. Telematics, also known as usage-based insurance, refers to a program offered by some car insurance companies that allows the insurer to monitor your driving habits, usually through a smartphone app. Variables they can track include your average speed, how hard you brake, the kilometers you travel, and more. Signing up for telematics is optional and could net you a discount of up to 25% upon your next renewal date. Car insurance companies are not supposed to use the data against you — they can only use it to grant you a discount (if you qualify, of course).

- Cultivate good driving habits: practise defensive driving to keep your record clear, obey your province’s traffic laws, and don’t make small claims.

Save 23% on average on car insurance

Compare 50+ quotes from Canadian providers in 3 minutes.

About the author

Alexandra is a content manager in the personal finance space, specializing in auto insurance. Her reporting has appeared in Canadian Business, the Toronto Star, the National Post, and the CBC.

.jpg)