REPORT by Provinces: Average car insurance prices rose in Q2, despite COVID-19 relief measures

Millions of drivers hoped for relief from rising car insurance costs when COVID-19 reached Canada. But our data show that rates increased in most provinces.

Millions of drivers hoped for relief from rising car insurance costs when COVID-19 reached Canada in March, leading to a lockdown and a plunge in the number of cars on the road. Unfortunately, car insurance rates increased for drivers in most provinces this spring, our latest data show.

In March, insurance companies rolled out a slew of measures designed to help customers (eliminating fees, allowing customers to pause payments, and more). At the same time, drivers adjusted their coverage to reflect the fact they were driving less. Nevertheless, the average price of insurance for new customers continued to rise in provinces with privatized car insurance systems. Prices rose in Alberta and the Atlantic provinces year-over-year, while they fell slightly in Ontario.

Pandemic or not, insurance companies say the underlying conditions that necessitated past price increases haven’t been resolved — things such as more costly claims due to more technological complexity in cars, for instance — hence the decision to implement rate increases despite an economic downturn. That’s why we at LowestRates.ca expect car insurance prices to keep rising through to the end of 2020.

The best thing consumers can do right now to contain their car insurance costs is to make sure they’re paying for the correct usage — if you’re no longer commuting to work, you should let your insurance company know so that pricing reflects how you use your car — and to shop the car insurance market for a better deal. While the average price is going up, many drivers will still be able to find a lower price by shopping the market.

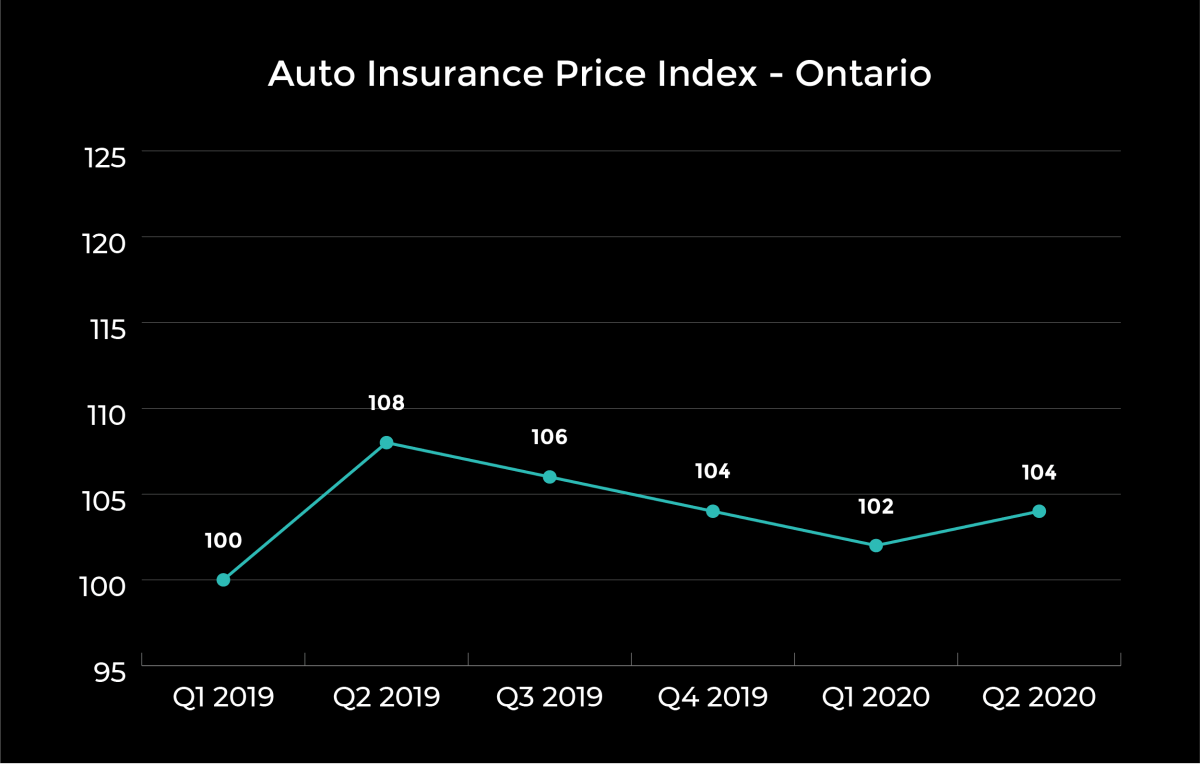

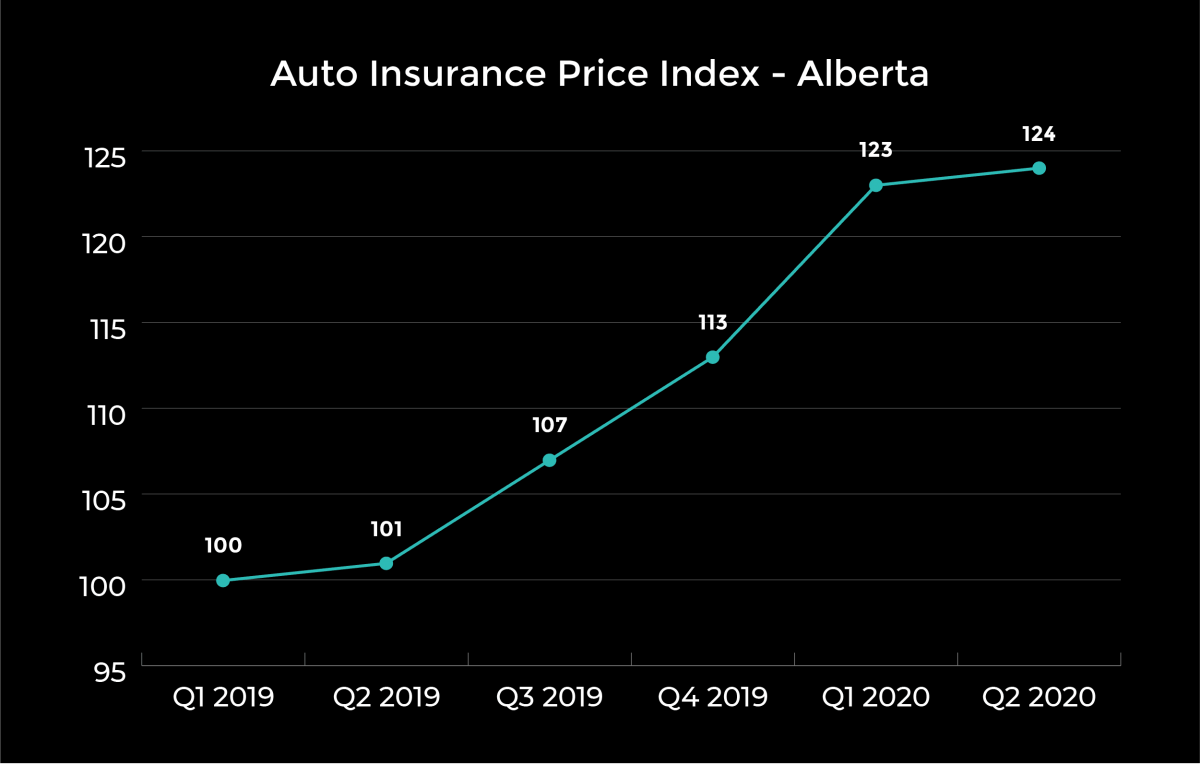

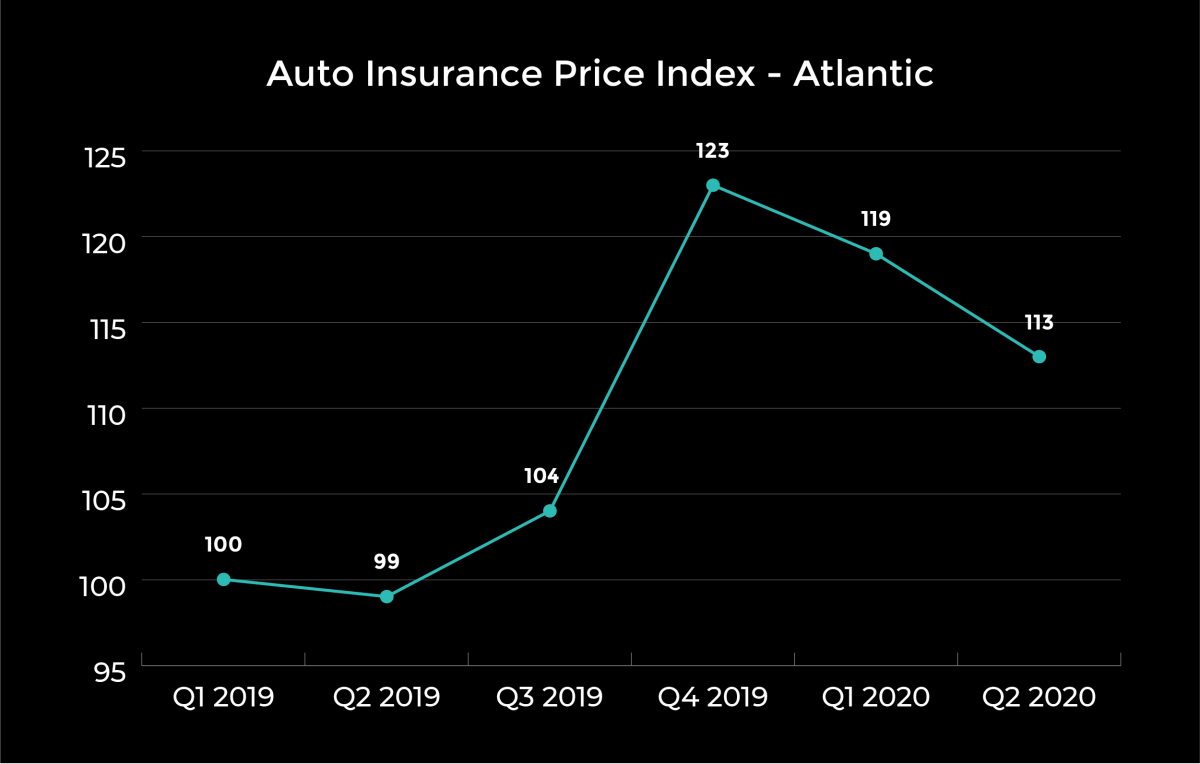

But before we delve any further into our analysis, a few notes about how to read the Auto Insurance Price Index. Our benchmark reading is 100 and a one point move above it represents a roughly 1% increase in prices. Our index represents the online marketplace on LowestRates.ca. It shows who’s shopping for car insurance and the prices they’re getting.

Now, take a look at our index and the change in the average car insurance rates by province.

Key highlights from the report:

- Car insurance prices rose in Alberta and Atlantic Canada, while prices fell in Ontario (year/year)

- COVID-19 discounts were not enough to offset rising car insurance prices (quarter/quarter)

- Insurance companies across Canada continue to remain concerned about rising claims costs

- Distracted driving and more technologically complex cars are leading to rising claims costs

- Insurance companies also blame government regulation and price caps for higher insurance prices. Insurers say these caps hurt competition and lead to higher prices for consumers

Prices in Ontario had been trending downwards, but that changed in the second quarter

Premium change (%) by age in Q2, year-over-year

Ages 18-24: -1.1%

Ages 25-44: +4.2%

Ages 45-79: -4.0%

Premium change (%) by gender in Q2, year-over-year

Women: -4.2%

Men: -3.8%

Car insurance rates in Ontario fell about 4% when compared to this time last year, with our index moving down from 106 to 104. However, for the first time in a year, we saw prices rise quarter-over-quarter, moving from 102 to 104, representing a roughly 2% increase.

Ontarians already pay some of the highest car insurance premiums in Canada. The industry’s stance is that insurance prices aren’t nearly as high as they should be based on the current level of coverage they offer Ontarians and the regulatory system in which they operate. Insurance companies say it’s hard to operate in Ontario and be profitable and have provided a number of reasons for this.

For one, many insurance companies believe that rates are still recovering from the previous Liberal government’s goal to lower premiums by 15% over a two-year timeframe. In Ontario, people who have been hurt in an accident also have the ability to sue for damages if they sustain injuries that are serious and permanent. Lawyer involvement often means 30% of benefit payouts end up going to legal fees, which some insurance companies have argued drives up insurance costs. The province also has a high incidence of auto insurance fraud, which leads to even more legal costs.

Insurance companies must request permission from the province to change their rates, and up until the pandemic, FSRA published the results at the end of each quarter. In recent years, a quarter hasn’t passed where the record doesn’t show the vast majority of Ontario insurers applying for a rate increase.

Fortunately, online marketplaces have been able to help consumers find cheaper car insurance rates, and for most of 2019, the prices on our site defied the trend in the wider marketplace.

But after three consecutive quarters of decline, car insurance prices for LowestRates.ca customers rose 2% in Ontario between the first and second quarters of 2020, reaching a reading of 104 on our index — just as rates of COVID-19 infections accelerated in the province.

In early spring, a chorus of personal finance experts, including LowestRates.ca, encouraged drivers to reach out to their insurers and update their annual mileage if they were driving less estimates as a way to save money.

The demographic that had the least success with this tactic were our youngest users: drivers 25 and under.

Young drivers wouldn’t have seen significant reductions in price when they applied for a quote on LowestRates.ca. Unfortunately, even lowering annual mileage won’t put a dent in car insurance prices for people 25 and younger because they are considered to be at an especially high risk of getting into a car accident and filing a claim.

However, comparing auto insurance rates is still important for young drivers. Because they can be charged high premiums (annual premiums of $4,500 a year or more are not uncommon), they stand to reap the most savings. Young drivers with a clean driving record can save hundreds of dollars a year by comparing rates. The best thing that young drivers can do to reduce their car insurance costs is to focus on building a conviction and claims-free driving record.

The driving demographic that would have benefitted the most from lowering their auto insurance premium is the over-45 crowd. Many of our older and financially established customers — who are increasingly making up a greater proportion of our user base — had several levers to pull when it came to lowering their car insurance rates: they could remove a car from their coverage, reduce their mileage, reduce their road coverage, or change their usage (pleasure instead of commuting).

It goes to show that there are many tactics experienced drivers can use to lower their car insurance rates. The most effective and immediate one is to compare car insurance rates. Awareness of online rate comparison sites appears to be growing. Gen X and Boomers are a growing proportion of our user base in 2019 and 2020 so far.

An overall drop in prices in 2019 on our site was likely caused by an uptick in customers between the ages of 45 and 79 visiting LowestRates.ca to compare prices. Our data shows that they were especially successful in finding lower car insurance rates on our site, which would have brought down the average. When prices rise, more people go online to search for new car insurance.

Looking ahead, government-imposed limits on car insurance prices may cause insurance companies to restrict who they offer coverage to, which could reduce options for consumers and lead to dramatic rate increases down the line. There are no indications that the Ford government will force a rate reduction like the Wynne government or implement pricing caps. LowestRates.ca’s position is that Ontario’s auto insurance system will require systematic changes, not short-term stopgaps.

Alberta insurance prices continue to skyrocket

Premium change (%) by age in Q2, year-over-year

Ages 18-24: +23.9%

Ages 25-44: +28.7%

Ages 45-79: +19.9%

Premium change (%) by gender in Q2, year-over-year

Women: +22.5%

Men: +22.2%

Higher car insurance prices are practically inescapable in Alberta.

Since the start of 2019, Alberta car insurance prices on LowestRates.ca rose 24%. Car insurance prices have been on the rise in Alberta ever since the Progressive Conservative government removed a 5% cap on rate increases in late 2019.

The pandemic seems to have blunted the upward trajectory of insurance prices. Rates between April and June increased by only 1%.

Few insurance companies applied for rate increases in the second quarter of the year, according to filings from the Auto Insurance Rate Board. Many requested no changes at all.

Auto insurance companies have long complained that government regulation has kept rates artificially low in Alberta. The industry has lobbied for the ability to raise insurance premiums by at least 20%

Even with the 5% cap gone, the insurance industry still claims that the insurance grid is keeping prices too low. Car insurance rates in Alberta operate under a grid system, which establishes the highest premium insurance companies can charge for basic coverage (third party liability and accident benefits).

The grid benchmark increased by 15% in January, but the car insurance market is still tight. Insurance companies say they are still recovering from the previously-imposed price caps while the cost of claims — propelled mainly by bodily injury claims — has grown. Financial results remain poor, leaving most insurers skeptical and cautious. Few insurers see Alberta as a growth opportunity and have implemented strict underwriting controls.

Many insurance companies have started requiring consumers to pay their annual premium upfront, denying them the ability to pay monthly. Some insurers have become more cautious when it comes to taking on new clients.

Some LowestRates.ca users in Alberta knowingly chose to purchase coverage from an insurance company offering them a higher insurance rate just to have the option to pay monthly.

The province has assembled a committee to examine options for auto insurance reforms in Alberta. While the report’s findings have not been made public, our view is that a return to a Notley-era cap on price increases will exacerbate the situation and lead to higher rates down the line. However, simply raising the price caps will not be enough to create a “viable and sustainable auto insurance system” that delivers “fair, accessible and affordable insurance for Albertans,” two of the stated goals of the review. Widespread systemic change is needed. In the interim, we expect auto insurance companies to continue being extremely selective about which drivers they will cover.

Drivers have limited recourse when it comes to dealing with rising rates. The best way to control and, over time, reduce your costs is to maintain a clean driving record and to shop around for rates before locking into a policy.

Car insurance is a custom product. Even in a climate of rising rates, there are still ways to save. One insurance company may be more favourable to you because of your unique driving history. The overall trend shouldn’t discourage drivers from shopping the market before locking into a policy.

Atlantic Canada has seen prices ease in recent quarters, but prices are still up for drivers compared to last year

Premium change (%) by age in Q2, year-over-year

Ages 18-24: +20.1%

Ages 25-44: +19.6%

Ages 45-79: -2.3%

Premium change (%) by gender in Q2, year-over-year

Women: +5.1%

Men: +17.6%

Our Atlantic Canada index is an amalgamation of auto insurance price data for Nova Scotia, Newfoundland and Labrador, P.E.I., and New Brunswick.

People shopping online for car insurance in Atlantic Canada have seen the most dramatic price swings on LowestRates.ca.

In the spring and summer of 2019, rates rose an eye-popping 24% on LowestRates.ca. As is the case in the mainland, car insurance companies operating in the Atlantic provinces claim that government regulations have forced them to charge less for coverage than what they perceive is necessary.

For example, Newfoundland and Labrador has special regulations around auto insurance. Companies are barred from rating customers based on age, gender, and marital status — a radical difference in the way auto insurance prices are calculated compared to Alberta and Ontario. These rules were introduced between 2003 and 2005 during an overhaul of the car insurance system in an attempt to make insurance cheaper and less discriminatory in the province.

By winter 2019, prices on LowestRates.ca for drivers in Atlantic Canada declined. The trend continued into the new year, with rates falling a total of 10 points by the end of the second quarter of 2020. We attribute the steep decline in early 2020 to a greater proportion of experienced drivers using our site to shop the market for a better deal.

Looking at Nova Scotia, which makes up the majority of LowestRates.ca’s Atlantic user base, the regulatory body that oversees the car insurance industry expects car insurance losses to increase by up to 7% in 2020. The Nova Scotia Utility and Review Board has also told insurers that they cannot factor in any of the relief measures they offered in the spring at the start of the pandemic to their underwriting. These are all signs that insurance will continue to get more expensive.

Atlantic drivers are succeeding at finding a cheaper rate online. As rates continue to rise, drivers should compare rates, especially around the time when your policy is up for renewal.

Our methodology

We set the index to 100 in Q1 2019 and use average prices from that quarter to gauge whether prices are moving up or down in relation to it.

We collect this data through our auto insurance quoter, which millions of Canadians use every year to compare car insurance prices and which was created in partnership with Applied Systems Canada.

Save 23% on average on car insurance

Compare 50+ quotes from Canadian providers in 3 minutes.

About the author

Alexandra is a content manager in the personal finance space, specializing in auto insurance. Her reporting has appeared in Canadian Business, the Toronto Star, the National Post, and the CBC.

.jpg)